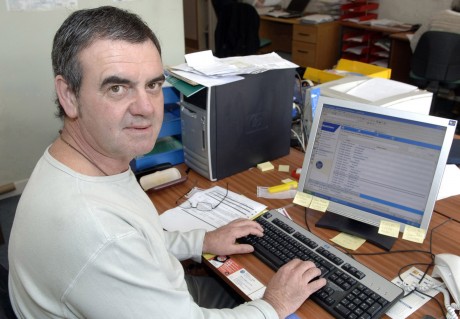

Kevin Lawrenson, Debt NI

The news that pay day loan lender Wonga will write off an estimated £220m worth of debt across the UK will have positive repercussions in Fermanagh.

Last week the Financial Conduct Authority took the unprecedented step of making the short-term lender cancel the outstanding debt of 330,000 borrowers.

The loans will be written off for borrowers with arrears of 30 days or more, while 45,000 customers who are in arrears up to 29 days will be asked to repay their debt without interest and charges, and can do so over an extended period of four months.

In another victory for customers the company will make immediate changes to how it assesses customers’ ability to repay loans.

Kevin Lawrenson who works in Enniskillen for Debt Advice NI explained that at least three of his clients will have their debts written off. He referred to three customers who will see their respective debts of £956, £613 and £472 wiped away and has called on more people to check with the company to see if they can have their debts cleared.

“Even if you do have a bit of money and you have a debt, it is like a string around your neck. Now that’s been cut for them.”

Despite the good news Kevin still questions the practice of the pay day loan company.

“There are 330,000 customers and they are to contact all customers by October 10. I’m waiting to see if that actually happens, because the contact between Wonga and people like myself is very lax.

“They say ‘we’re determined to drive up standards’, but the standards should be there from day one. It’s not an industry where you learn as you go along and I would just keep re-enforcing that fact to customers.

“Wonga are to implement measures to improve its affordability to ensure the customers are treated fairly. Most financial institutions if you and I walked in off the street and said ‘how you doing, I would like to borrow some money’.

What’s the first thing they want to know? What is your income? Have you any other commitments? So they are to implement measures to improve affordability, but surely they should have been there in the first place. You don’t just give money without asking these questions, it is about affordability.”

Reaffirming his position regarding pay-day loans Kevin has stressed that those in financial difficulty consider the Credit Union.

“Times are tough and they need somewhere to get money, but I keep going back to it. If you can’t get it from your bank go to your local Credit Union, always use your Credit Union, they are somebody you can walk into and talk to. Nobody can walk into Wonga in Fermanagh and say ‘how you doing’.

“Why would you borrow money from someone you don’t know, all you do know is advertising. Why wouldn’t you walk into your local credit union and say hello. You don’t have to scratch you head looking for a response you can just walk in.”

If you are having problems with debt or are a customer with Wonga you contact Kevin for advice at Debt Action NI on 02866329045 or ring the freephone helpline on 08009174607.