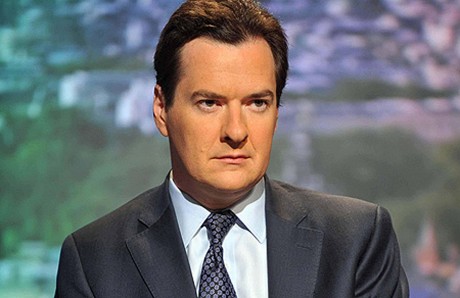

George Osborne

PENSIONERS across Fermanagh can look forward next year to easier access to their private ‘pension pot’.

At present, people can take out a quarter of their pension pot tax free on retirement. But, that will change as from April, 2015, due to last week’s Budget.

And, instead of paying 55% tax if you take out the remainder, people will be taxed at 20 per cent.

The Chancellor’s proposals have had a mixed reaction, locally.

Siobhan Peoples, the manager of Fermanagh Citizens Advice Bureau said those able to put money aside into savings would find an increase in how much they can save, tax-free helpful.

However, one in four people who came to her office for help had some kind of debt problem.

“The Chancellor does need to remember that for many people, saving money is a pipe dream as they are struggling to make ends meets.”

Leo Rooney, a pensions’ adviser with MacNeary & Rasdale, Enniskillen doubted that some senior citizens could leave themselves penniless.

“Obviously that could be the case if you’re going to take it out all at once. But, let’s say you’re talking about a £100,000 pension pot, once you start taking out the remainder, £75,000, you will hit with a big tax slap. Anybody who would do that is stupid.

“No, I think it is certainly a good thing, and I think the vast majority of people are saying that.”

The Chancellor, George Osborne, announced he would be providing £20 million over the next two years to work with consumer groups and industry to develop this new right to advice.

This was welcomed by Ms Peoples.

“The range of decisions people have to make while they save and when they retire means many don’t always know how to use their pension pot to their best advantage.

“Giving people choice and access to trusted, independent financial advice will help them to make informed decisions about their pension.”

But, she added: “We know that many of our clients and, indeed our own staff, do not have pensions schemes made available in their work.

“With an ageing population, and a squeeze on household finances, making it easier and cheaper for people to save for the future is vital.”