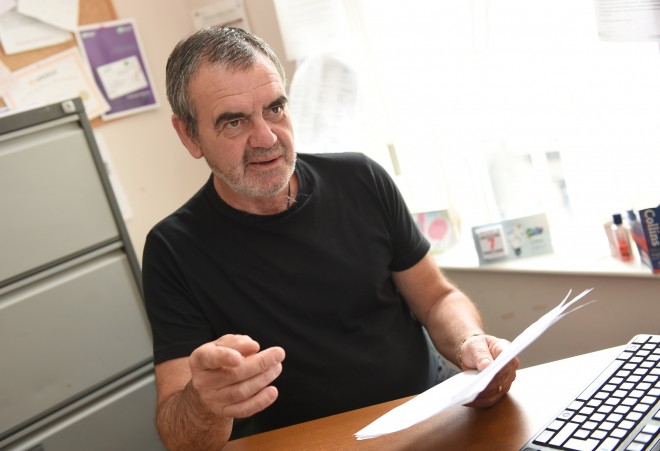

Kevin Lawrenson of Fermanagh’s Citizens Advice

JUST WEEKS after another hike in local rates it has emerged that a growing number of families here are struggling to keep on top of the council’s tax on households. And it has been claimed that many are turning to ‘payday loans’ to help meet their rates bills.

While wages increases across many sectors have flatlined, rates have seen a steady increase of some 15 per cent in the past six years. Now, according to a local debt advice expert, many people are simply unable to keep up with their rising rates bills.

Kevin Lawrenson from Fermanagh Citizens Advice says the organisation has seen a growing number of people struggling with their rates bills. He says some residents cannot afford to pay their rate bills from years ago and that pressure continues to mount with signficiant annual increases to contend with.

“Rates are still a big problem here. Clients are coming into us with arrears of rates and they are not in a position to pay these, on top of the current rates bill just issued in April 2018.

“Clients are making payment offers and if they have arrears going back three to four years they do not know what account the money is being used for unless they state a year, so if you have arrears of rates and it is for differing years, you need to make it clear which year you are paying off.”

The 3% rate increase was decided at a special council meeting in February with the council describing it as an ‘inflationary district rate increase.’ The domestic district rate is paid by residents in the county and has increased by £0.93p per month accumulating to an extra £11.16 a year.

Rates revenue is used to fund and improve local Council services such as refuse collections and recycling, leisure and recreation, building control and planning, tourism and events, community services and to invest in capital and infrastructure projects within the district.

Kevin has also noted an increasing number of people who are availing of Payday loans, and coming under financial pressures when they are unable to keep up with the repayments.

“Payday loans are becoming more regular. They are mostly loans where the person has a Guarantor which means that if the borrower cannot pay then the Guarantor is liable. In many cases an income and expenditure has not been done regarding the affordability to pay of the borrower or the Guarantor,” concluded Mr Lawrenson.